Why Our Services Are Different

In the traditional way of doing business, one would have a tax professional, investment advisor, insurance agent, and estate planner all in different locations. Most of the time, the advice that one professional gives impact the advice of the other professionals, but rarely do these professionals ever talk with each other.

At our office, we have access to bookkeepers, tax preparers, accountants, financial planners, investment managers, insurance agents, and estate planning advisors. Our clients receive advice from various professionals, working together, at one location.

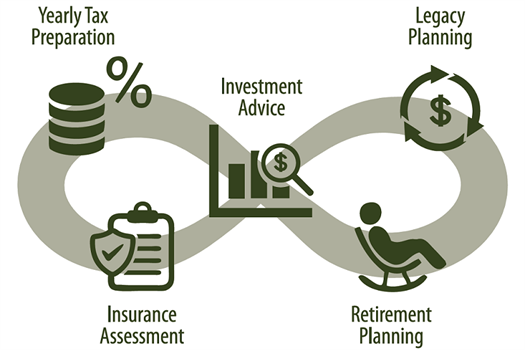

The Infinity Financial Process

We believe in a well rounded approach to your overall financial health. Our goal is to help you Protect, Grow, Use, & Bestow your assets. The Infinity Financial Process is formulated to act as a road map for your life journey. From yearly tax preparation to investment advice to retirement income and legacy planning, we guide you along the way.

Helpful Links