Why Our Services Are Different

In the traditional way of doing business, one would have a tax professional, investment advisor, insurance agent, and estate planner all in different locations. Most of the time, the advice that one professional gives impact the advice of the other professionals, but rarely do these professionals ever talk with each other.

At our office, we have access to bookkeepers, tax preparers, accountants, financial planners, investment managers, insurance agents, and estate planning advisors working together at one location. Our clients receive advice from various professionals, focusing on your needs, to chart your financial success together.

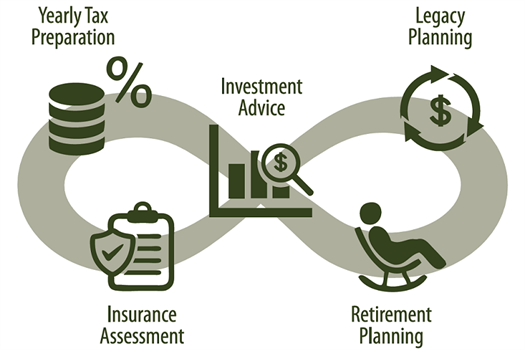

The Infinity Financial Process

We believe in a well-rounded approach to your overall financial health. We have created “The Infinity Financial Process”, a proprietary process that is formulated to act as a road map for your life journey, helping you Protect, Grow, Use & Bestow your assets. From yearly tax preparation to investment advice to retirement income and legacy planning, we guide you along the way.